Business Insurance in and around Shrewsbury

Shrewsbury! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Prepare Your Business For The Unexpected.

Do you own a fabric store, a music school or an architect business? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on what matters most.

Shrewsbury! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, business owners policies or builders risk insurance.

Let's review your business! Call Jeff Nelson today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

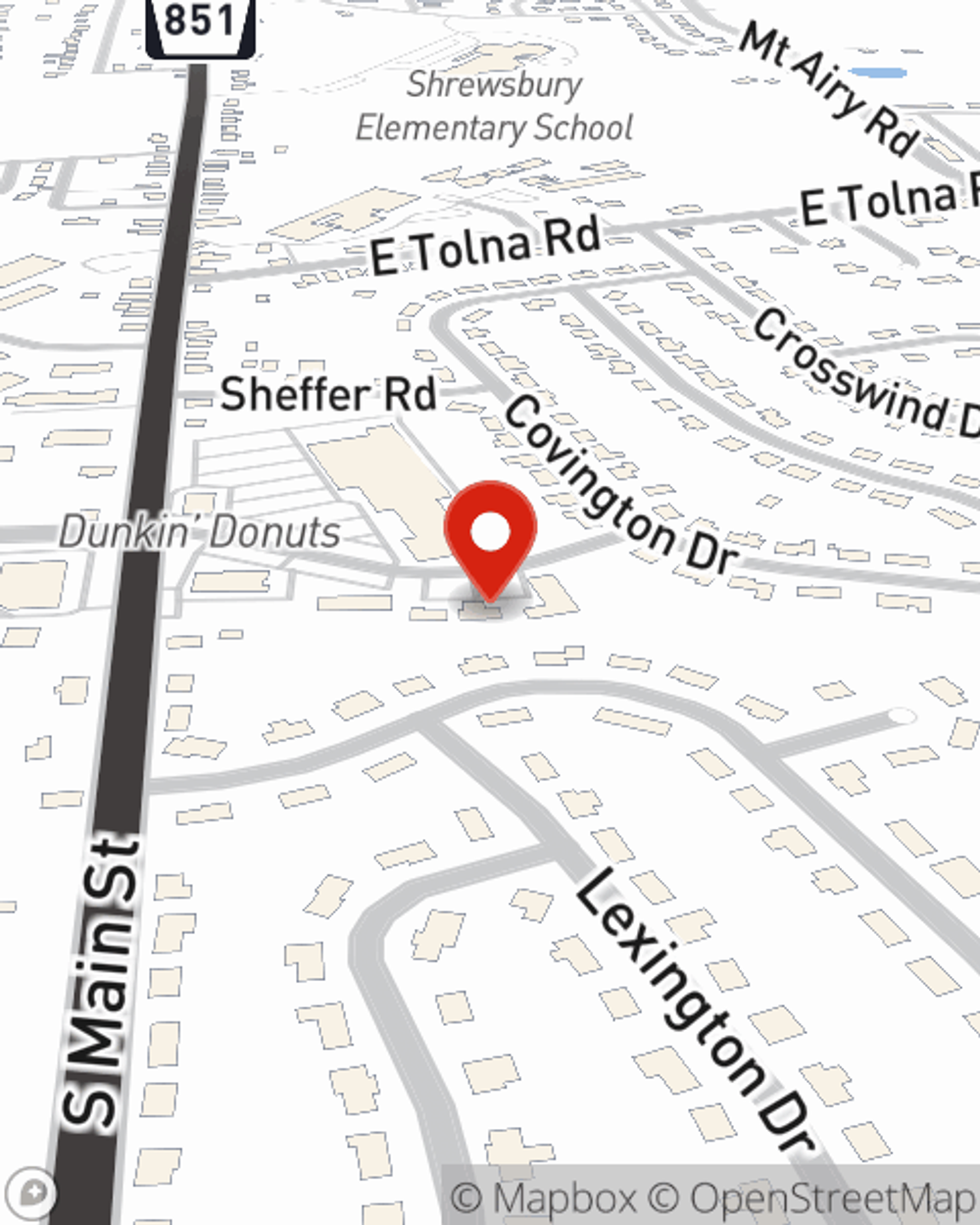

Jeff Nelson

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?